Key Figures

5-Year Overview H1 2019 - 2023

(in CHF million)

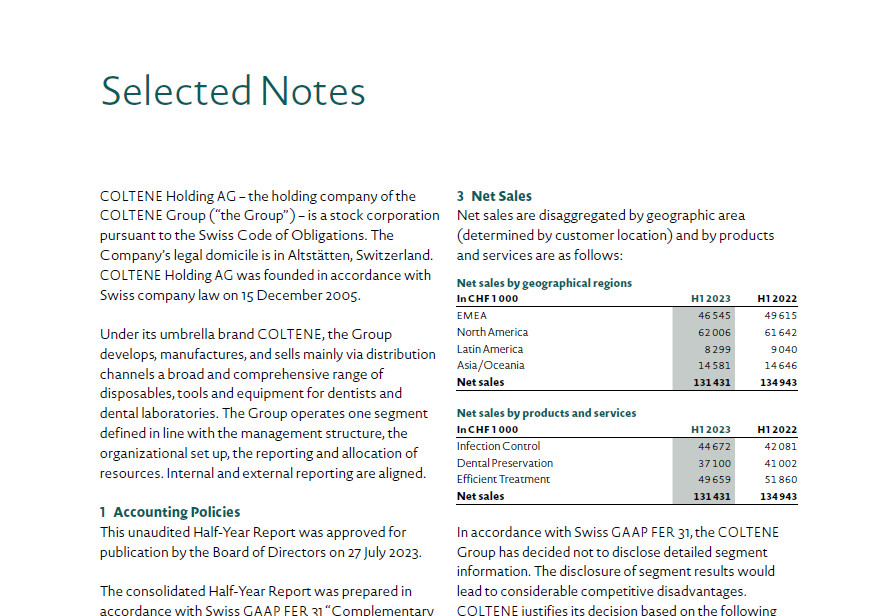

Net Sales

Net Profit

EBIT

Free Cash Flow

H1 Net Sales by Region in %

H1 2022

North America

45.7

Latin America

6.7

EMEA

36.8

Asia

10.8

Highlights H1 2023

Local-currency sales growth

In local currency terms, sales increased in a challenging business environment.

Product portfolio MDR certified

By H1 2023, nearly all sales came from EU Medical Device Regulation (MDR) certified products.

CHF, free cash flow

Free cash flow was strong thanks to improved net working capital.

CHF, reduction of inventories

Inventories went down as backlogs were reduced and warehouse management was optimized.

Foreword

Dear Shareholders,

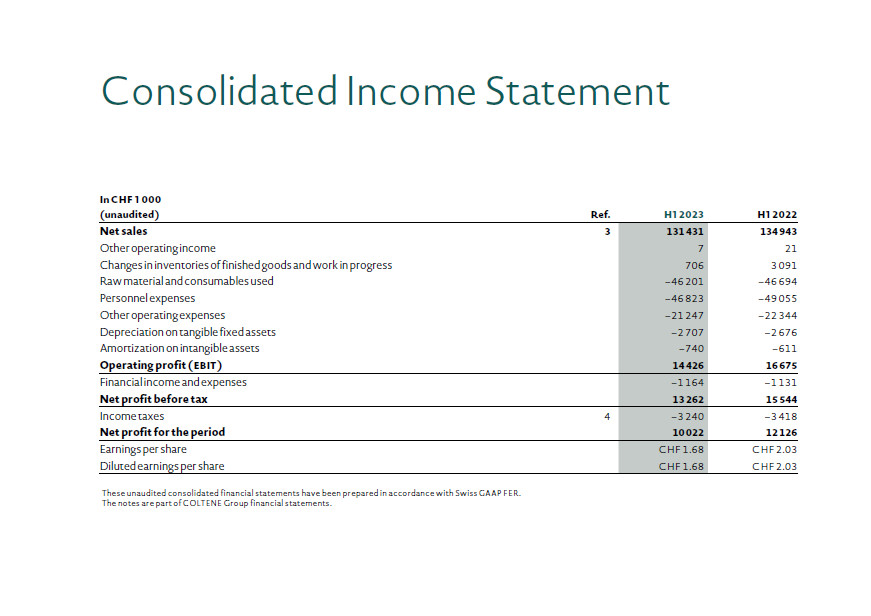

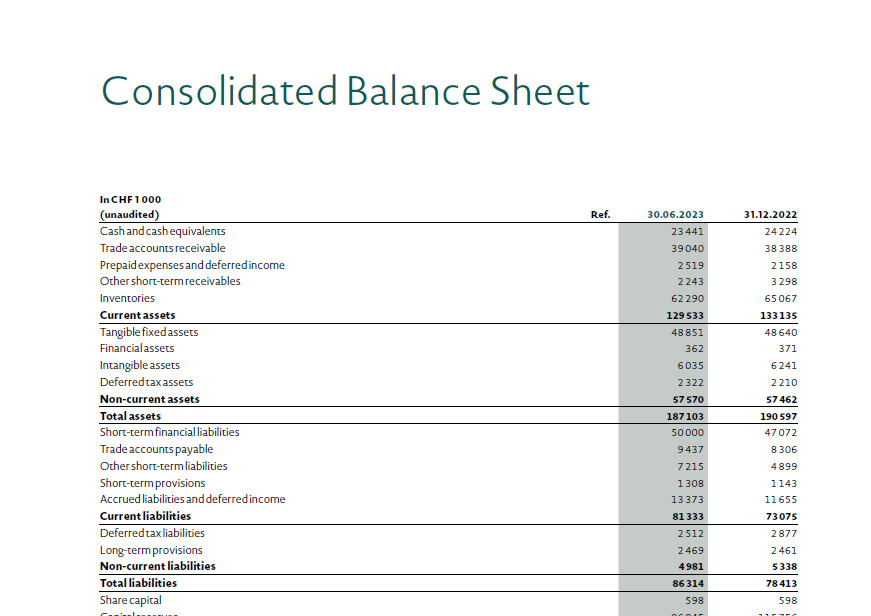

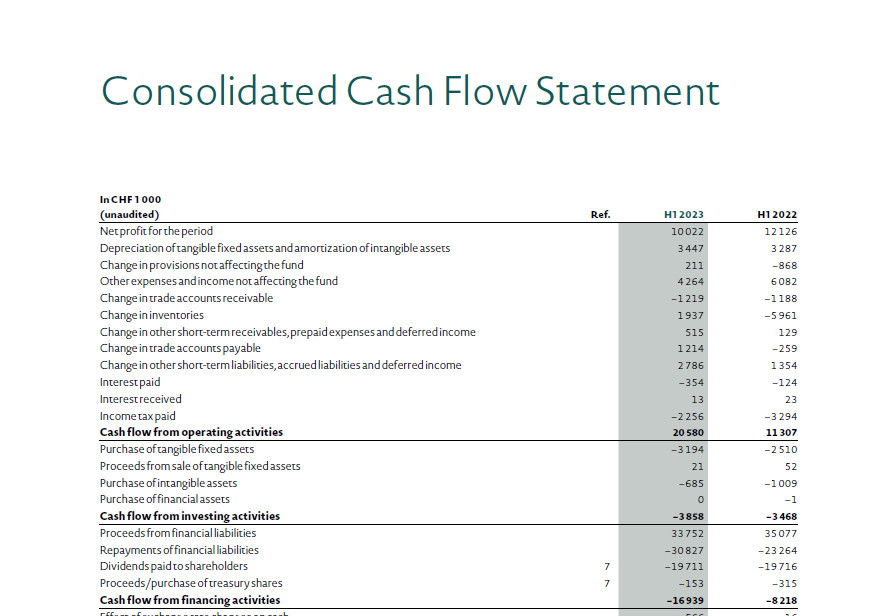

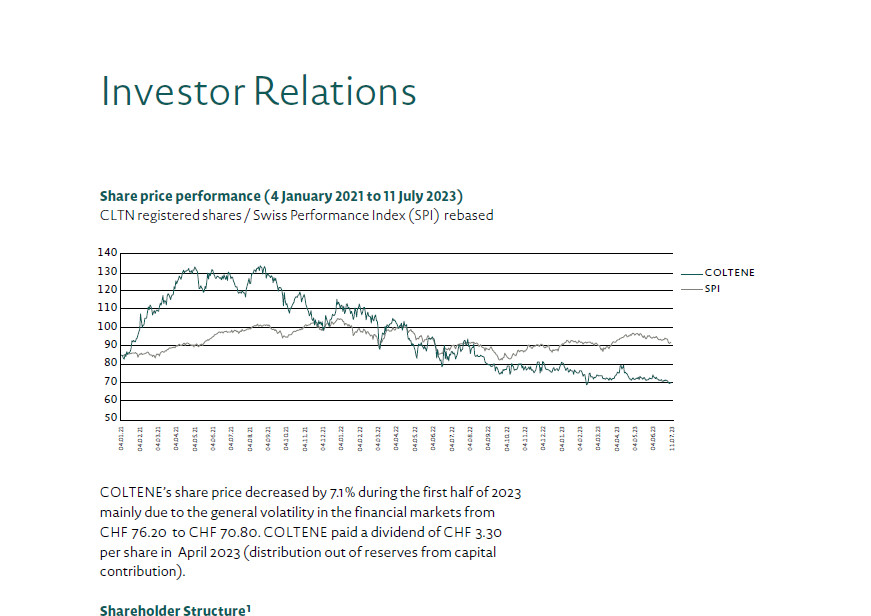

In the first half (H1) of 2023, the COLTENE Group achieved a pleasing business performance in a challenging environment. Net sales were CHF 131.4 million. At constant exchange rates, this corresponds to an impressive 1.7% increase year-on-year, up from a strong H1 2022 still riding the economic recovery after pandemic lockdowns were lifted. In reporting currency terms, however, net sales were down 2.6% from a year earlier (CHF 134.9 million). Operating profit (EBIT) for H1 2023 was CHF 14.4 million (H1 2022: CHF 16.7 million). The EBIT margin was 11.0% (H1 2022: 12.4%) and net profit was CHF 10.0 million (H1 2022: CHF 12.1 million). Actions taken to optimize net working capital were highly effective, delivering a strong positive boost to free cash flow, which rose to CHF 16.7 million (H1 2022: CHF 7.8 million).

The backlogs affecting instrument reprocessing equipment as a result of supply chain bottlenecks were successfully reduced. At the same time, however, the state of the global economy weighed on demand. Despite these challenges, sales in this product group were up, year-on-year. By contrast, endodontic file sales were prevented by delays in the certification process caused by the notified body TÜV Süd. The certifications have now been issued, allowing our endodontic files to reach markets with effect from H2 2023. In the core regions, some sales suffered in H1 2023 as retailers reduced their existing inventories of Dental Preservation and Efficient Treatment products. The greatest impact on sales, however, came from negative exchange rate effects driven by the euro (EUR), US (USD), and Canadian (CAD) currencies. These effects reduced reported net sales by 4.3% and impacted all four regions.

At constant exchange rates, sales by product group saw year-on-year changes as follows: Dental Preservation – 5.5%, Efficient Treatment + 0.3%, and Infection Control + 10.6%.

New product and service launches are imminent. These will not only increase patient safety but also save time in dental practices while providing helpful information for service technicians. After debuting in the first quarter at the world’s premier dental trade show, IDS in Cologne, Germany, these products will be launched in key COLTENE markets in H2 2023. Via the my.coltene digital platform, COLTENE/SciCan device data is analyzed and instrument reprocessing is documented automatically. The new IC-Track system for instrument sets used in patient treatment allows tracing and tagging these sets throughout their cleaning, sterilization, and disinfection process for each individual patient. The system is also compatible with older-generation and third-party equipment and as such makes a significant contribution to patient safety.The outlook for H2 is positive despite a challenging economic environment.

The COLTENE Group looks to H2 2023 with confidence. We expect that our distribution partners will have cleared their inventories in the course of H2. We are also enthusiastic about the products and services we will be launching in the coming months to continue driving digital transformation at COLTENE and unlock new customer segments. In addition, COLTENE is going to benefit from the newly issued certifications that have cleared our endodontic files for sale and from further economic recovery in China. Given its healthy balance sheet, moreover, COLTENE is well positioned for growth through acquisitions.

Based on the factors listed, the Group confirms its medium-term target of an EBIT margin of 15% with sales growth modestly above the market average.

On behalf of the Board of Directors and Group Management, we would like to thank our employees for their hard work, dedication, and commitment. We also wish to thank our valued customers, business partners, and shareholders for the confidence they place in the COLTENE Group.

Sincerely yours,

Nick Huber

Chairman of the Board of Directors

Martin Schaufelberger

CEO

Download the Full Half-Year Report 2023

Contact

Markus Abderhalden, CFO

Coltène Holding AG

Feldwiesenstrasse 20

9450 Altstätten

Phone: +41 71 757 54 80

E-mail: investor@coltene.com

Financial Calendar

Release of Annual Report and media and analyst conference on 2023 financial year

Annual General Meeting 2024

Release of Half-Year Report and media and analyst conference on 2024 half-year results